Latest Features

The Helium Outlook

Increased helium prices and reduced availability resulting from recent global shortages have created hard choices and challenged pocket books for tech divers and instructors. There are potentially positive developments on the horizon. But the situation is nuanced, as InDEPTH’s Ashley Stewart explains after conducting a worldwide survey of instructors regarding local helium pricing and availability and speaking to the helium market experts. What does the future portend? Get out your wallet, take a deep breath (of nitrox), and dive in!

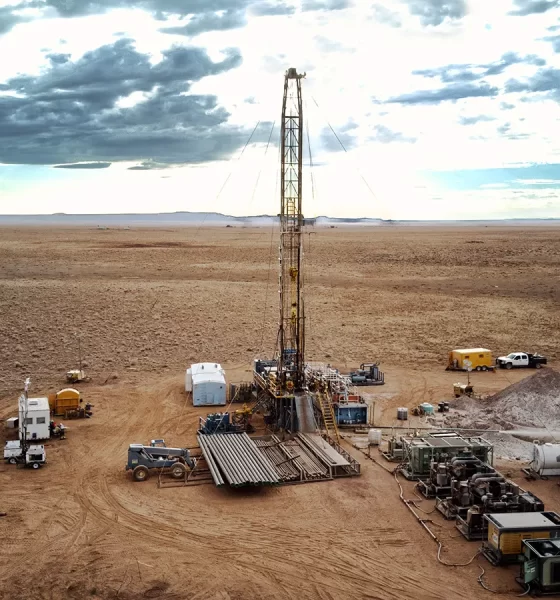

by Ashley Stewart. Lead image: A helium exploration well in the Holbrook Basin, Arizona, USA Photo courtesy of Desert Mountain Energy Corporation.

? Predive Clicklist: HELIUM – MIKEY VAX (LYRIC VIDEO) ??

The outlook for helium is mixed.

Global supply of the lightweight, non-narcotic gas used in diving breathing gas mixes is expected to increase significantly, but market experts expect it will take years before prices start to fall. In the meantime, the high price of helium is changing the way technical divers approach projects and training.

Helium is Earth’s only nonrenewable resource. The colorless, odorless, and tasteless inert gas is generated deep underground through the natural radioactive decay of elements such as uranium and thorium in a process that takes many millennia. Once it reaches the Earth’s surface, helium is quickly released into the atmosphere—where it’s deemed too expensive to recover—and rises until it ultimately escapes into outer space. Some helium mixes with natural gas underground and can be recovered through drilling and refinement. Divers use helium to decrease the density and narcotic effect of the gases they breathe, which accounts for about 2-4% of global usage, but more common uses include MRI scanning and manufacturing.

The diving industry, like the many industries that rely on helium, is coming off of a significant shortage that in 2022, according to an InDEPTH survey of Global Underwater Explorers (GUE) instructors at the time, caused many technical dive shops around the world to raise prices, limit fills, or stop selling trimix altogether. Our latest GUE survey suggests while availability has improved, prices are generally still getting worse, and instructors are beginning to see the effect of the high prices on participation in technical training.

“Without rebreathers, tech diving is simply dead,” said Italy-based shipwreck explorer and GUE instructor Mario Arena, who told InDEPTH that he has to source helium wherever possible and sometimes ship it for more than 1,000 kilometers for his expeditions.

The Market

“There should be more supply,” helium-industry consultant Maura D Garvey told InDEPTH. “But expect prices to stay where they are, or even escalate.”

The helium shortage in 2022, experts told us, was caused by major disruptions in the few countries that produce a majority of the world’s helium. The most significant of these was a delay of the planned opening of a new Russian gas processing plant in Siberia, due to a fire and then an explosion. The plant is expected to produce as much as 60 million cubic meters of helium per year, about as much as the US—the world’s largest helium producer—produced in all of 2020.

The Siberian plant, known as the Amur Gas Processing Plant, which is owned by state owned Russian energy company Gazprom, opened in September, boosting availability, helping to explain why Russia was the country with the lowest helium prices in our survey.

Meanwhile, Qatar, which produces about a third of the world’s helium, is also working on a fourth helium plant that would significantly boost global supply. High prices are also driving significant new exploration in the US, Canada, and Europe, however, though it may impact prices and availability locally, these represent small contributions globally compared to the potential in Russia and Qatar.

While supply is increasing, geopolitical tensions are making distribution more difficult, increasing prices. While there are no sanctions on Russian helium, for example, there are sanctions on Western companies bringing American-made cryogenic containers into the country to pick up Russian helium. Note that the majority of the global container fleet is made up of US-based Gardner Cryogenic ISO (International Organization for Standardization) containers. Most of Amur’s helium is destined for China and India, which do not have Russian sanctions and will displace Western suppliers. In fact, Russia is currently building a helium pipeline to China. Cargo ships moving helium out of Qatar are also avoiding the Suez Canal, increasing the costs.

Helium industry consultant Phil Kornbluth expects the new plants in Siberia and Qatar will increase the global supply of helium by 50% by the end of the decade, which will not only make the gas more abundantly available, but significantly decrease prices.

The diving industry, however, may look much different by then. Years of turbulence in the availability of helium, and the seemingly never-ending price increases are already driving a shift to closed circuit rebreathers, and training agencies are considering introducing the units earlier in training so that aspiring deep divers don’t have to deal with the significant cost of open-circuit diving.

The Survey

InDEPTH surveyed GUE instructors to get a pulse on helium pricing and availability for technical divers. Helium prices vary based on factors including distance from producers and geopolitical issues, both of which can increase the complexity, and therefore cost, of transport. The highest reported price among the 30 responses from instructors around the world was US$0.14 per liter/$4.53 per cubic foot in Cyprus, where orders need two weeks of lead time. At that price, a set of trimix 18/45 (18% O2, 45% He, balance N2) in double HP100s (similar to D12s) would cost around $408 for the helium alone, and trimix 15/55 would cost $498.

The least expensive region for helium among survey respondents was in Triton, Russia, where one instructor gets helium for $0.04 (3.7 cents) per liter/US$1.04 per cubic foot. For comparison, the same set of 18/45 there would cost just $94.

The price of helium in Bonaire, which during the 2022 shortage survey was the costliest destination for helium, fell to $0.11 (10.5 cents)/US$3 per cubic foot from $0.14/US$4 per cubic foot for GUE instructor German Arango, principal of Area 9. “Our supplier is telling us that there is a possibility of some price reduction mid-2024,” Arango said. “We will see.”

Instructors generally reported modest price increases and greater availability since our last survey at the height of the 2022 helium shortage. The biggest change between the 2022 and 2023 surveys is that instructors appeared more fed up with the requirements for and lack of attendance in open-circuit technical training. GUE’s training requires 25 experience dives after its introductory technical course before moving on to its introductory CCR course, or the next open-circuit course, Tech 2. The cost of these experience dives varies greatly based on factors including the profile of the dives and local helium prices.

“We have seen a huge drop in open-circuit Tech 1 and Tech 2 (GUE’s open-circuit technical diver levels) level dives and training,” said California-based instructor Tom Figueroa, who pays $0.11 (10.8 cents) per liter/$3.06 per cubic foot. “It appears these programs, especially Tech 2, are on their way out.”

Japanese instructor Yosuke Ogiwara agreed. “This situation is not easy to teach a Tech 1 course,” said Ogiwara, who pays $0.12 per liter/$3.40 per cubic foot, when he can get it, in Tokyo and can’t get it at all on the island of Okinawa.

Germany-based instructor Daniel Schulte pays $0.13 per liter/$3.68 per cubic foot. “The necessity to do T1 + 25 experience dives prior to CCR1 will kill also T1 (T2 is already dead),” Schulte told InDEPTH, referring to a GUE requirement to complete experience dives before moving on to CCR classes.

Some years ago, GUE created a more direct path to rebreather training, allowing divers to take its CCR1 introductory rebreather course without first taking its Tech 2 open circuit course. According to president Jarrod Jablonski, the organization is currently evaluating a variety of pathways that provide access to rebreather diving even earlier in the technical training process. If approved, these changes would likely take place before the end of 2024.

“For now, GUE has approved the opportunity for waiver of the 25 deep experience dives after Tech 1 training, greatly reducing the cost of gasses needed for progression to the CCR1 program,” Jablonski told InDEPTH, meaning that GUE divers can take their CCR1 course directly after completing Tech 1. “The waiver is case-dependent and not compulsory for a given instructor, but can be a useful stop-gap measure while GUE formalizes an optimal path forward given all the variables involved.”

However, Kornbluth, the consultant who predicts 50% more supply and significant price decreases by 2028, said making significant changes based on the current helium market is likely premature. “Assuming no major source of helium disappears, there will be an oversupply and, if there’s an oversupply, helium is like any other commodity and prices will fall.”

DIVE DEEPER

gasworld: The 2023 worldwide helium market Helium tightness relaxes – return to supply-demand balance remains uncertain by Maura D. Garvey.

gasworld: Amur gas project set for ‘biggest impact’ on helium by Phil Kornbluth

Reuters: Russia’s Gazprom to launch two Amur gas processing lines in 2024 – TASS

InDEPTH: Helium Super Summit 2023 Recap by Michael Menduno (NOV 2023)

InDEPTH: The Price of Helium is Up in the Air by Ashley Stewart (July, 2022)

DIVE MEDIC: The Future of Helium is Up in the Air Talk by Michael Menduno (May 2020). Everything you wanted to know about helium and its history and its application to diving.

InDEPTH Editor and Investigative Reporter Ashley Stewart is a Seattle-based journalist and tech diver, and an owner of Eight Diving. Ashley started diving with Global Underwater Explorers and writing for InDEPTH in 2021. She is a GUE Tech 2 and CCR1 diver and on her way to becoming an instructor. In her day job, Ashley is an investigative journalist reporting on technology companies. She can be reached at: ashley@gue.com